Working capital is the difference between company’s total current asset and the total current liabilities. In simplified terms, It’s the amount of current asset that is left out if all current liabilities are paid.

Working Capital = Current Assets – Current Liabilities

Bankers, financial institutions and other creditors compute working capital to know the short-term liquidity of a company. Its also known as cash credit. Many companies are also using the term ‘net current asset’ instead of using the term ‘working capital’.

Current assets are those assets which can be converted into cash within the operating cycle of the company. Examples of current assets includes, cash and cash equivalents, temporary investments, inventory, accounts receivable and prepaid expenses.

Current liabilities are the debts that is due within one year of the balance sheet date. Example of current liabilities includes, accounts payable, salary and wages payable, accrued expenses and income tax payable.

Working capital or WC defines the company’s ability to meet obligation in normal course of business. This means the resulting figure will show you short-term financial health or liquidity position of the company.

Generally companies with comfortable working capital are more attractive to investors. Year to year increase in it indicates company’s growth and health.

If the company has negative working capital then it indicates that the company may have liquidity problem and it may be in trouble paying back to creditors or go bankrupt. It depends on the type of business. For instance, a grocery store or retail chain business generally works on very little working capital in comparison to other businesses.

Even a high working capital is not a good thing as it indicates that the business has too much inventory or the management does not know where to invest excess cash.

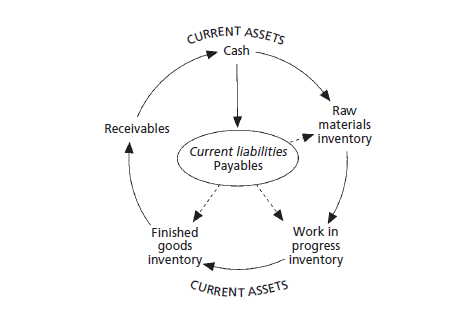

Working capital cycle

Working capital cycle is the time period that the company takes to convert it’s net current liabilities and assets into cash. This indicator will manage the liquidity position of the company. If the duration is shorter, then the company will be in a good liquidity position. If it’s long, it indicates that funds of the company is getting stuck in the business cycle. Companies will always try to lower the cycle for enhancing liquidity position.

As an investor we suggest you to analyse working capital and its components thoroughly to understand company’s liquidity position or to know whether the company possesses sufficient assets to cover its short-term debts.

By studying company’s balance sheet, as an investor you can easily understand whether company can expand its operation by using internal funds or it require funds from bank or financial markets.

Here is the flow of money round the working capital cycle

Here are the steps to understand the flow of working capital cycle:

- Out of the cash you have, you must buy some raw materials (inventory) to produce finished products. With this purchase, you have converted one form of current asset (cash) to another form of current asset (inventory). If you have bought raw materials from your creditors in credit, then you have created current assets (inventory) with the help of current liabilities (Accounts payable).

- Now your job is to convert the inventory to finished product. To do that, you will be spending cash towards, wages, power and supplies. In case of large supplies or expenses, you may purchase it on credit. If you are buying it in cash, then current asset will be reduced on payment of cash or else in case of credit, current liabilities will go up due to the short term obligations you have created.

- The process of creating finished product will lead to some of the products in semi finished conditions, known as work in progress (WIP). These inventories will get converted at a later stage to finished produce. However, during the process you will always have WIP as current assets.

- After spending some more cash and/or incurring current liabilities in organization’s day to day activities, you will get finished product to sell in the market.

- Now you can sell your finished product to customers. Based on the type of business, you have to give credit to your customers as per your credit policy. If the customers are paying cash, then its good as directly you are converting finished goods to cash. Or else, in cash of credit, you have to wait for the credit period to get converted to cash. In credit sale, your finished goods will get converted to accounts receivable. After receiving payments, accounts receivable will get converted to cash.

To continue your business, you are again required to follow the working capital cycle to generate cash. Your company’s liquidity position will depend how effectively you are managing your working capital cycle to generate cash so that it can be pumped into the cycle every day.

Example to calculate working capital of a company

Company A has following details;

- Cash on hand = Rs. 500,000

- Accounts receivable = Rs. 250,000

- Inventory = Rs. 1,000,000

- Accounts payable = Rs. 400,000

- Short-term debt = Rs. 50,000

- Outstanding expenses = Rs. 100,000

To begin out calculation, we have to find out current asset and current liabilities.

In this case current asset of company A = Rs. 1,750,000 (cash on hand + accounts receivable+inventory), and

current liabilities of company A = Rs. 550,000 (accounts payable+short-term debt+outstanding expenses).

Now working capital of company A = Current asset – current liability = Rs. 1,750,000- Rs. 550,000 = Rs. 1,200,000.

Companies don’t disclose working capital on the balance sheet. To find out actual liquidity and availability of fund, you are required to analyse current assets and liabilities and then calculate the liquidity position as explained above.