PAN card is used as a identity proof and for deduction of TDS by the employer or deductor. In such cases its very important to verify pan card details of the person to know whether it’s a genuine or not.

There can also be situations where you do not know your Permanent Account Number and urgently require your card number to give it to someone. In this type of situation you can use below steps to know your PAN details or verify your pan card details in case of doubt.

PAN card details of any person can be verified by filling out core details of the individual or firm or anyone other persons in the prescribed format. IT department has lunched know your pan service online to verify your card details and to know card application status online.

For PAN Card Verification you should have following details in hand;

Date of Birth/Incorporation: In DD/MM/ YYYY Format*

Name of the Applicant: Surname* –Middle Name – First Name

Surname and date or birth/incorporation is mandatory fields.

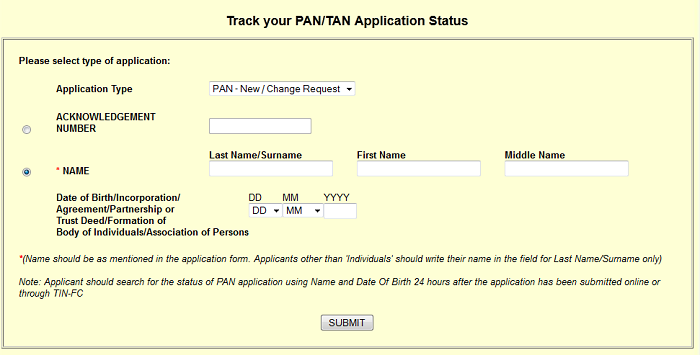

Please remember this facility is not for verification of permanent account number. Its provided to track your PAN card status online. But this facility can also be used as a verification tool for permanent account number.

Please remember this facility is not for verification of permanent account number. Its provided to track your PAN card status online. But this facility can also be used as a verification tool for permanent account number.

After filling up the above details there are chances that the name and date of birth matches with other person. In that case it will ask you details of the father’s surname, middle name and first name.

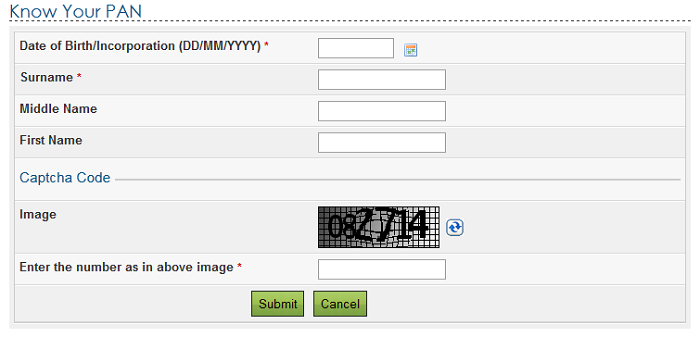

One can use an alternative link that is available at income tax website. This link will also verify your Permanent Account Number details:

After entering the details in the second link you will get following details of your PAN card;

- Permanent Account Number

- Permanent Account Number Holder’s First Name

- Permanent Account Number Holder’s Middle Name

- Permanent Account Number Holder’s Surname

- Jurisdiction

- Remark on PAN Card

Both ways you can know your pan card details or verify someone’s PAN card details.

sir, i lost my pan card and i wanna pan no. for my personal work pls sent me my pank link. thanx