Section 8 of IGST Act, 2017 says when supply of goods and/or services will be treated as intra-state supply. As per section 8, supply of goods will be treated as Intra-state supplies if the location of the supplier and the place of supply of goods are in the same state or same union territory.

Here are three exceptions to the above provisions-

- Supply of goods to SEZ developers or SEZ units

- Supply of goods by SEZ developers or SEZ units

- Goods imported to the territory of India till they cross the customs frontiers of India.

- Supplies made to a tourist referred to in section 15. As per explanation to section 15, a tourist is a person who is not normally resident in India, who enters India for a stay of not more than 6 months for legitimate non immigrants purpose.

In the above exceptional cases, supplies of goods and/or services shall not be treated as intra-state supply even though the location of supplier and place of supply are in the same state or same union territory. Supplies falling under the above exceptional list are to be treated as inter-state supply instead of intra-state supply.

Intra-state supply of services

As per section 8(2) of IGST Act, 2017, supply of services shall be treated as intra-state supply where the location of the supplier and the place of supply of services are in the same state or same union territory.

However, when supply of services is to or by a special economic zone developer or a special economic zone unit, then supply of services shall not be treated as intra-state supply. Instead, it will be treated as an inter-state supply.

Importance of establishments of distinct person in intra-state supplies

As per the explanation 1 to section 8, in the following three cases establishments of same entity shall be considered as establishment of distinct person for the purpose of GST;

- Where a person has an establishment in India and any other establishment outside India.

- Where a person has an establishment in a state or Union territory and any other establishment outside that state or Union territory; or

- An establishment in a state or Union territory and any other establishment being a business vertical registered within that state or Union territory.

A person carrying on a business through a branch or an agency or a representative office in any territory shall be treated as having an establishment in that territory.

Supply of goods and/or services between any of the above establishments shall be treated as supply between establishment of distinct persons.

As per circular number 48/22/2018 GST dated 14.06.2018, services of short term accommodation, conferencing, banqueting etc provided to a SEZ developer or SEZ unit shall be treated as an intra-state supply.

What happens when the supplier and/or place of supply is in territorial water

Territorial sea is a belt of coastal waters extending at most 12 nautical miles from the baseline of a coastal state. As per section 9 of the IGST Act, if the location of the supplier is in the territorial water then for the purpose of GST, it shall be deemed that the location of such supplier is in the coastal state or Union territory where the nearest point of the appropriate baseline is located. Same concept is applicable when the place of supply is in territorial water.

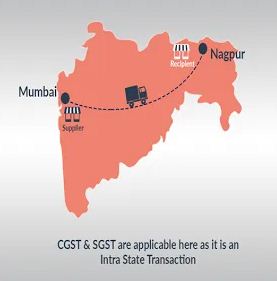

Rate of GST on intra-state supplies

On intra-state supplies of goods and services, two rates of GST will be charged on the taxable value. The first one is the central tax (CGST) levied on all intra-state supplies of goods or services or both. Second rate of GST levied is state/Union territory tax (SGST/UTGST).

If supply is inter-state, then instead of CGST and SGST, you should charge IGST. For instance, if you are supplying goods and/or services to a SEZ unit located in the same state where your place of supply is located, then you should charge IGST as it’s treated as inter-state supply.

GST must be collected and paid by the taxable person.

Supply of alcoholic liquor for human consumption is outside the purview of GST law. CGST and SGST/UTGST not levied on following items;

- Petroleum crude

- High speed diesel

- Motor spirit/petrol

- Natural gas and

- Aviation turbine fuel

While determining levy of CGST and SGST or IGST based on place of supply you must take into consideration following two things;

- Location of the supplier based on its place of registration.

- Place of supply based on the registered place of business of the recipient.

Example

XYZ Corporation supplies electronic products from its registered office in Hyderabad. It supplies goods to different outlets inside telangana state.

In this case the location of XYZ corporation as well as the place of supply is in the same state i.e. Telangana. Therefore it will be treated as an intra-state supply of goods. XYZ should charge CGST and SGST as applicable to the products supplied.

Suppose the taxable value is 10,000 rupees and the rate of tax is 9%. Here is a illustration showing how CGST and SGST would be charged in this case;

| Particulars | Amount in Rupees |

| Taxable Value | 10,000 |

| Add: CGST @ 9% | 900 |

| Add: SGST @ 9% | 900 |

| Total Price to be charged for supply of goods / services | 11,800 |

Suppose, in our above example, XYZ corporation supplied goods from its Hyderabad location to Bhubaneswar, odisha. In this case, the location of the supplier is Hyderabad and place of supply is Bhubaneswar, Odisha. Therefore it shall be treated as an inter-state supply of goods and as such IGST as applicable to the product should be charged.