As a GST registered person, you can authorise an approved goods and services tax practitioners (GSTP) to furnish information, on your behalf to the government. These GST practitioners are provided separate login ID and password to enable them to work on behalf of their clients without asking for the client’s GST user ID and passwords.

If you want to change goods and services tax practitioners, then you can do so by unselecting the previous one and then by choosing a different new GSTP on the GST portal.

A GSTP enrolled in one state or union territories shall be considered as enrolled in other states or union territories.

Who can be a GSTP – Eligibility criteria to become a GST Practitioner

Here are the persons eligible to apply to act as goods and services tax practitioners (GSTP);

- retired officer of the Commercial Tax Department of any State Government or of the Central Board of Excise and Customs, Department of Revenue, Government of India, who, during his service under the Government, had worked in a post not lower than the rank of a Group-B Gazetted officer for a period of not less than two years;

- enrolled as a sales tax practitioner or tax return preparer under the earlier indirect tax law for a period of not less than five years;

- Graduate or Postgraduate degree or its equivalent examination having a degree in Commerce, Law, Banking including Higher auditing, or business administration from any Indian University established by any law for the time being in force;

- Degree examination of any Foreign University recognized by any Indian University as equivalent to the degree examination mentioned in sub-clause (i)

- Any other examination notified by the Government for this purpose

- Any degree examination of an Indian University or of any Foreign University recognized by any Indian University as equivalent of the degree examination

- Has passed any of the following examinations, namely:-

- Final examination of the Institute of Chartered Accountants of India;

- Final examination of the Institute of Cost Accountants of India;

- Final examination of the Institute of Company Secretaries of India.

Here are the certain conditions all these eligible persons must satisfy before applying;

- Must be Indian citizen

- Person of sound mind

- Not adjudicated as insolvent

- Not been convicted by a competent court

What goods and services tax practitioners can do

A authorised GST practitioner can perform one or more of the following activities on behalf of a registered person:

- Furnish details of outward and inward supplies;

- Furnish information for e-way bill;

- Can make amendment/cancellation of GST returns;

- Can assist in filing monthly/quarterly/annual GST returns;

- Can file refund claims or pay taxes on behalf of the registered persons (confirmation from the registered person shall be sought);

- Can appear as an authorised representative before any officer of the GST Department, Appellate authority and the Tribunal.

A GST practitioner can also assist in making an application for GST registration on behalf of a person. However in this case confirmation from the registered person is a must.

How to enrol as a GSTP

Here are the steps to be followed to enrol as a GSTP;

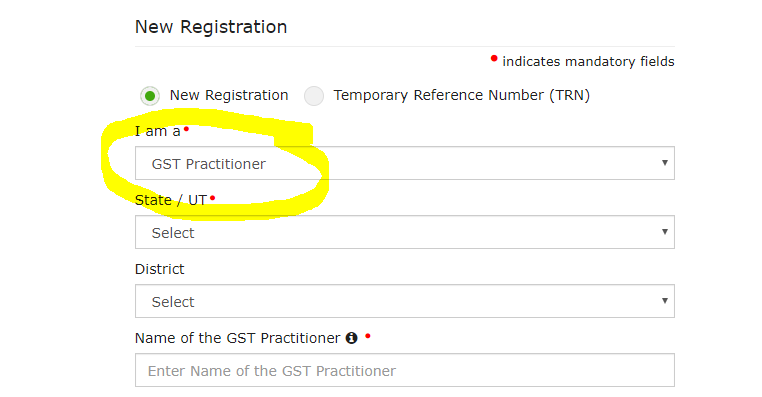

- Application has to be submitted through the GST common portal. Before submitting you need to check whether you are eligible to get appointed or not. In the initial application request form, you need to select the “GST practitioner” option from the drop down as shown in the picture below. After which you need to submit FORM GST PCT- 01.

- Application will be scrutinised and a certificate will be issued. It can also be rejected. If enrollment is done then it will remain valid till its cancelled. In case, the Application is accepted, the applicant will be issued a certificate in FORM GST PCT – 02

- Such enrolled persons need to pass an examination conducted by NACIN within the period allowed.

Important points applicable to a goods and services tax practitioner

Here are certain additional important points relevant for you to know more about a GST practitioner;

- When a registered person opts to furnish return through a GSTP, such person is first required to give consent to prepare and furnish the return on their behalf. After getting a request, the GSTP needs to accept the authorisation. Responsibility for correctness of the return filed by GSTP continues to rest with the registered person.

- The registered person can withdraw authorisation at any time.

- GST practitioner is required to affix their DSC on the statement prepared by him or electronically verify using his credential.

- After filing by the GSTP, a confirmation is sought from the registered person over email or SMS.

- In case the GSTP is found guilty of misconduct then, enrollment will be liable to be cancelled.