In old Companies Act 1956, Section 159,160,161,162 and Schedule V were dealing with the company Annual Return & related provisions. Now company annual return provisions are combined together in Section 92 of the new Companies Act 2013.

As per the new law, annual return is compulsorily required to be filed with the registrar of companies or ROC in the prescribed form every year by every company irrespective of their nature, i.e. private, public, listed, unlisted, or status, i.e. active, dormant or under amalgamation.

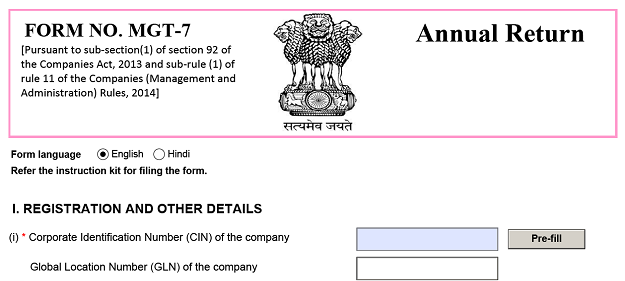

MCA vide Circular No 8/2014 dated 04.04.2014 has clarified that annual return in terms of section 92 of the Companies Act, 2013 will be in form MGT 7 and will be applicable for financial years commencing on or after 1st April, 2014. This means from financial year 2014-2015 onwards, Companies are required to file annual return in form MGT7.

Under the old companies act 1956, annual return was required to file for the period starting from the last AGM to the date of current AGM. Now, new companies act 2013, requires companies to prepare and file annual return in the prescribed form MGT7 containing the particulars as they stood on the close of the financial year i.e. for the period starting from 1st of April to 31st March.

Annual return for a company has to be filed with the Registrar of companies or ROC within 60 days from the date of Annual General Meeting or AGM. This means, if company’s AGM date is 30th September then annual return has to be filed by 29th November (being 60 days from 30th September).

If the AGM is not held in any year then the annual return as required under section 92 has to be filed within 60 days from the date on which company’s Annual General Meeting should have been held together with the statement specifying the reasons for not holding the Annual General Meeting, on payment of such fee or additional fee as prescribed.

Also Read: Time Limit For filing Company Annual Return in Form MGT7 with ROC

If a company fails to file annual return before the specified period as mentioned in section 403 with additional fee then the company shall be punishable with fine which shall not be less than 50, 000 rupees but which may extend to 5, 00,000 rupees and every officer of the company who is in default shall be punishable with imprisonment for a term which may extend to six months or with fine which shall not be less than 50, 000 rupees but which may extend to 5, 00,000 Rupees, or with both.

As required by sub section (3) of Section 92, of the Companies Act 2013, companies are required to prepare extract of Annual Return in Form MGT-9 which shall form part of Board’s Report instead of balance sheet as provided under the old Companies Act 1956.

If the annual return is for a listed company or for a company having paid up share capital of 10 Crore rupees or more or turnover of 50 Crore rupees or more then it shall be certified by a Company Secretary in practice and the certificate shall be in Form MGT8.

Also Read: Who should sign company annual return in form MGT7

As per Section 92 of Companies Act 2013, every company shall prepare an annual return in the form MGT-7 containing the particulars as they stood on the close of the financial year regarding;

- Its registered office, principal business activities, particulars of its holding, subsidiary and associate companies;

- Its shares, debentures and other securities and shareholding pattern;

- Its indebtedness

- Its members and debentures holders along with changes therein since the close of the previous financial year;

- Its promoters, directors, key managerial personnel along with changes therein since the close of the previous financial year;

- Meeting of members or a class thereof, Board and its various committees along with attendance details;

- Remuneration of directors and key managerial personnel

- Penalty or punishment imposed on the company, its directors or officers and details of compounding of offences and appeals made against such penalty or punishment;

- Matters relating to certification of compliances, disclosure as may be prescribed;

- Details, as may be prescribed, in respect of shares held by or on behalf of the foreign institutional investors indicating their names, addresses, countries of incorporation, registration and percentage of shareholding held by them and

- Such other matters as may be prescribed

Fee for filing Company Annual Return MGT7 with ROC

Fee for filing company’s annual return with Registrar of Companies in Form MGT7 are based on the share capital of a company.

Normal Fee for filing (in case of company having share capital)

| Nominal Share Capital | Normal Fee Applicable in Rupees |

| Less than 1,00,000 | 200 |

| 1,00,000 to 4,99,999 | 300 |

| 5,00,000 to 24,99,999 | 400 |

| 25,00,000 to 99,99,999 | 500 |

| 1,00,00,000 or more | 600 |

Fee for filing in case of company not having share capital is Rupees 200.

Additional Fee for Delay in filing Form MGT7

| Period of delays | Fee applicable |

| Up to 30 days | 2 times of normal fees |

| More than 30 days and up to 60 days | 4 times of normal fees |

| More than 60 days and up to 90 days | 6 times of normal fees |

| More than 90 days and up to 180 days | 10 times of normal fees |

| More than 180 days | 12 times of normal fees |

Also Read: Penalty for late filing or failure to file Company Annual Return

IF THERE IS A DISPUTE REGARDING THE NAME OF THE COMPANY. HOW SHOULD THE MGT 7 BE FILED.IF A WRONG FILING IN RESPECT OF THE NAME OF THE COMPANY HOW IS IT TO BE RECTIFIED AND WHAT ARE THE PENAL PROVISIONS.

Regards,

Prithviraj

IF MGT 7 FORM IS FILED IN A WRONG NAME WHAT ARE THE CONSEQUENCES.