If you are following financial news channels, websites and research reports, then by now, you must have heard about the term CAGR. In case till now, you are not able to figure out what is the CAGR and how compound annual growth rate is calculated, then this article might be a great help.

CAGR stands for the Compound Annual Growth Rate.

Compound Annual Growth Rate (CAGR) is a measure of an investment’s annual growth rate over time, also referred to as rate of return, with the effect of compounding into account.

In other words, a CAGR is the rate of return (RoR) at which an investment grows from its beginning balance to its ending balance by assuming that the profits are reinvested over the period. It’s a widely used measure of growth of an investment that can fluctuate in value.

Compound annual growth rate helps to calculate and determine growth rate of an investment over a specific period of time longer than one year.

CAGR is a good comparative measure which helps to compare two or more alternatives to evaluate how well one investment has performed against others or a market index.

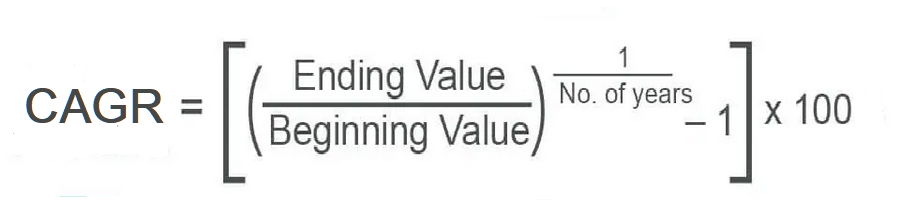

Formula to calculate CAGR-Compound annual growth rate

The compound annual growth rate or CAGR is calculated by using following formula;

100 is multiplied to get CAGR in percentage.

Where:

EV stands for Ending value

BV stands for beginning value

n stands for number of years

You need the ending value of the investment, the beginning value, and the number of compounding years to calculate the compound annual growth rate.

What CAGR can tell you

Compound Annual Growth Rate (CAGR) has many benefits.

CAGR is used as a measure for comparing a variety of investments over a period of time. It tells you how much you have earned on your investments every year during a given interval. You can compare it with another company to know how your investment has performed over a period of years.

For example, suppose you have invested Rs 1,00,000 in a mutual fund for 3 years. At the end of the 3rd year, the value of your investment is at Rs 1,85,000.

At the end of the 3rd year if you calculate your return from the investment, you will get Rs 85,000, which is 85% on your original investment of Rs 1,00,000. It has given you the total return at the end of the 3rd year. However, it’s not giving the return that you have generated each year. This is where compound annual growth rate will help you.

CAGR = [(185000 – 100000)^(⅓)] – 1] * 100 = 23%

Every year your investment has given you 23% return over the last 3 years.

Pros and Cons of CAGR

Compound Annual Growth Rate (CAGR) is used as a measure to calculate average growth rate of an investment. By calculating past average return, you can estimate the future rate of return for a longer period of time.

CAGR gives you a comprehensive idea of your return on investment to compare it with other investment options.

Compound Annual Growth Rate (CAGR) calculation is very straightforward. You need to have your beginning investment value, ending value and number of years to know your average return for a period.

Investors can compare the CAGR to evaluate how well one stock or investment has performed against others or against the market index.

However, Compound Annual Growth Rate (CAGR) also has few drawbacks. It’s not a true return rate. It generally describes the rate of return at which an investment can grow in future based on past performance.

In our above example, you have seen that we have calculated a Compound Annual Growth Rate (CAGR) of 23%. It means every year your portfolio grows by 23% to reach at Rs 1,85,000. However, it’s practically not possible as we are calculating the average return by taking the ending and opening value of the investment.

Some years, you may have higher return while in some other years your return may be lower. In one or two years you may have a negative return based on market conditions.

This means your investment in our above example could not have moved at a constant rate of 23% every year. It could have become Rs 1,50,000 in year 1, Rs 1,36,000 in year 2, and finally Rs 1,85,000 in year 3.

Compound Annual Growth Rate (CAGR) calculation does not take actual yearly rate of return into account. It gives a smoothed annual average return that gives the illusion that there was a steady growth rate each year. In other words, it provides the growth rate as if the changes occurred evenly at the same rate over each year.

Compound annual growth rate (CAGR) is a very good measure to evaluate an investment option, but it will not tell you the whole story. Compound annual growth rate (CAGR) can only be used when the investment is in lumpsum.

You can not use CAGR for your Systematic investment plans (SIPs) as it does not take periodic investment into account. It’s common to use the Average Annual Return (AAR) instead of CAGR when looking at systematic investment plans in a mutual fund.

Also Read: How fundamental analysis helps to find stocks for trading